Selling the rights to your old catalog has become a common path for musicians.

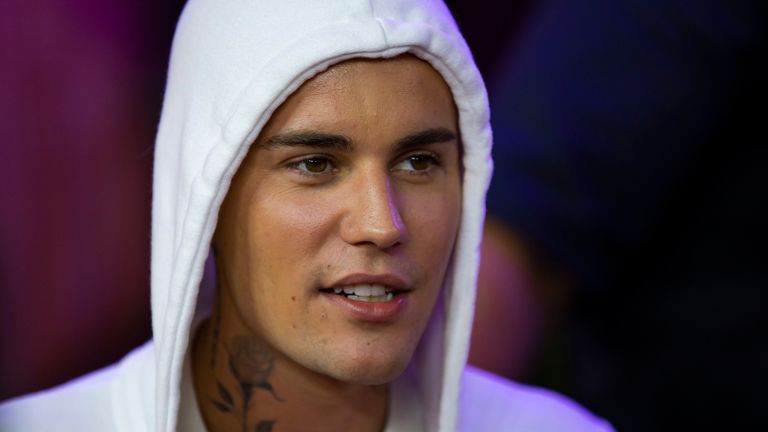

so justin bieber didn’t really break new ground the right to sell his work Sold to Hipgnosis Songs Capital for $200m (£162m).

What’s slightly surprising about the deal, though, is that Bieber, 28, is younger than many of the entertainers of the past few years.

Most blockbuster deals involve so-called “traditional” entertainers such as Bob Dylan, Neil Young, Bruce Springsteen and Fleetwood Mac, rather than younger artists.

The reason Bieber and other artists sell their rights is simple — they get a lump sum payment that provides financial security for them and their loved ones.

For buyers, the rationale is that songs can be turned into a revenue stream in a variety of different ways, including streaming, physical purchase of CD or vinyl records, downloads, live performances or licensing their use to filmmakers, TV shows and beyond. More and more computer games.

By buying large numbers of expired catalogs at scale, buyers can build a portfolio diversified enough to appeal to all tastes, generating a steady revenue stream regardless of changing trends.

These buyers, such as Hipgnosis, also argue that by focusing on this area, they can more successfully monetize the song by actively managing the product portfolio.

From a buyer’s perspective, though, Bieber is a slightly riskier deal because of his relative youth.

read more:

Sting sells music rights

Why are so many superstars selling their music rights?

Bieber still has years to go – for better or worse

People like Springsteen and Dylan are known numbers: with established listeners and fan bases, they’ll happily keep paying for their music, and as a result, the revenue their work generates is predictable.

Given their age, they are also less likely to be involved in a scandal that would make their work harmful to consumers.

Bieber, on the other hand, has many more years left, so he has plenty of time to alienate his fanbase through his behavior or produce sub-par new work, turning fans off from his past efforts.

Bowie was a pioneer in monetizing old catalogs

Music fans will be surprised to learn that one of the pioneers in monetizing old records was actually one of pop music’s greatest innovators – David Bowie.

In 1997, he and his management team came up with the idea of selling asset-backed securities to investors and sharing the returns from future royalties for the next 10 years. He raised $55m (£44m) by selling these “Bowie bonds” and, ironically, once bought back the rights to some of his early recordings from his former manager.

Building on this idea, Hipgnosis founder Merck Mercuriadis sought to more aggressively commercialize the rights backing the catalog, seeking to make the song an asset class in its own right, and do so through the vehicle of a stock market listing.

Mr Mercuriadis, a former manager of acts including Beyoncé, Elton John, Morrissey and Guns N’ Roses, raised £1.2bn from urban investors such as Axa and Investec, who like the promise of a reliable income stream. Ideas can stay the same regardless of the economic weather. This enabled him to purchase the rights to more songs.

Hipgnosis founder has competition

Mr. Mercuriadis’ credits include Blondie, Chic (whose frontman Nile Rodgers is a close friend) and Barry Manilow, but there is competition.

His rivals include New York-based Primary Wave, which has a 20,000-song catalog featuring artists such as Aerosmith and Bob Marley, and Round Hill Music, which like Hipgnosis is listed on the London Stock Exchange. Its catalog includes the Beatles’ hits “From Me to You” and “She Loves You,” as well as the Beatles’ first single, “I Wanna Be Your Man,” written by the Rolling Stones.

Then there’s the Los Angeles-based Iconic Artists Group, founded by music industry veterans Irving Azoff, ex-manager of The Eagles and Jon Bon Jovi.

It owns the rights to works by artists Linda Ronstadt, Dean Martin, Nat ‘King’ Cole and the Beach Boys.

There are other big established global music groups that have also been busy buying rights. For example, Sony of Japan bought the copyright of Springsteen’s old tracks last year, while Universal Music of the United States bought Dylan’s works at the end of 2020. Meanwhile, Warner Music bought the rights to Bowie’s old tracks last January for $250 million. year.

Doubts about the business model

Another curiosity about the Bieber deal reflects skepticism in some quarters about the business model.

Shares of the Hipgnosis Songs Fund are trading at a significant discount to the company’s net asset value per share (what each share would realize if the company were to dissolve, sell its assets, and return the proceeds to shareholders).

This reflects the fact that the market doesn’t believe some of the songs in the company’s portfolio are worth their money. Hipgnosis values its catalog at $2.2bn (£1.78bn), but the company’s current stock market valuation is just over £1bn.

The discounts – described by Mr Mercuriadis as “unacceptable” last month – have prevented the company from raising more money from investors to buy more songs.

So it wasn’t the Hipgnosis Songs Fund that bought Bieber’s catalog, but the eponymous Hipgnosis Songs Capital, which isn’t listed on the stock market but is owned by private equity giant Blackstone.

The latter, like the Hipgnosis Songs Fund, is advised by Hipgnosis Song Management – which, to add to the confusion, is majority-owned by Blackstone and managed by Mr Mercuriadis.

Bieber’s deal is unlikely to be the last Hipgnosis Songs Capital closes. It is reportedly the frontrunner to buy the old Pink Floyd catalogue, though it is said to be due to a deal between bandmates Roger Waters and David Gilmour. Bad relationship between them hinders sales.

More broadly, other deals are also likely to be struck, many involving British artists. A weaker pound makes their catalog more valuable to U.S. buyers paying in dollars.