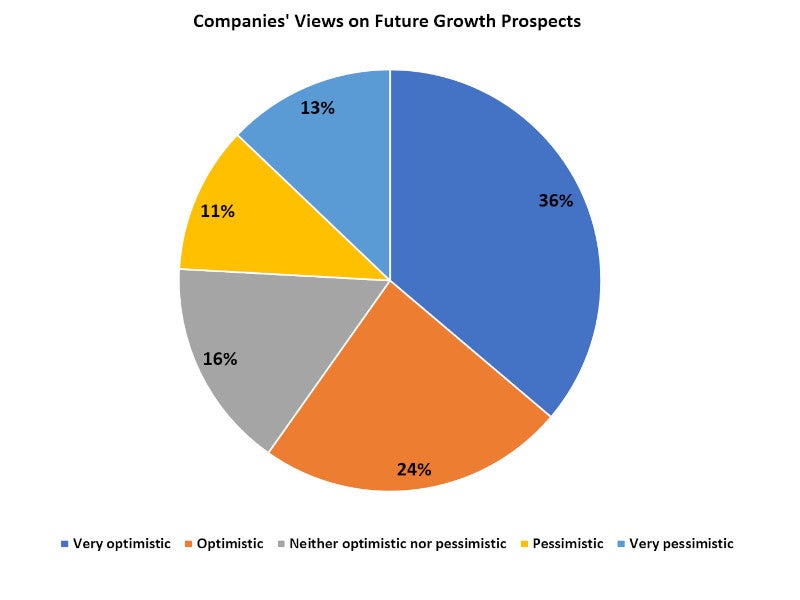

Business optimism fell in September 2022 compared to August 2022, as businesses expressed concerns about rising inflation and its impact on the broader economy, according to an ongoing Verdict poll.

Verdict has been conducting polls to examine trends in business optimism during COVID-19, which is reflected in companies’ perceptions of their future growth prospects during the pandemic.

An analysis of poll results recorded in September 2022 showed that optimism about future growth prospects fell by two percentage points to 60% from 62% in August 2022.

Optimistic respondents fell to 24% from 26% in August, while very optimistic respondents remained at 36% in September.

Respondents who were pessimistic rose 1 point to 11% in September, while those who were very pessimistic fell 2 points to 13% from 15% in August.

Neutral (neither optimistic nor pessimistic) respondents rose 3 percentage points to 16 percent from 13 percent in August.

The analysis is based on 373 responses received from Verdict website readers between September 1 and September 30, 2022.

Australia’s business confidence falls to lowest level since April 2020

Seasonally adjusted S&P Global Australian Manufacturing PMI™ (PMI™) fell to 53.5 in September from 53.8 in August. The findings suggest that the health of Australia’s manufacturing sector has improved over the month, although the overall pace of growth has slowed.

The slowdown in employment due to hiring challenges, lower supplier performance due to supply chain disruptions, and significantly lower pre-production inventory levels were the main reasons for the decline in growth.

The Purchasing Managers’ Index also showed that business optimism fell to the lowest level since April 2020, largely due to concerns over the cost of living crisis and the impact of inflation on the economy.

Rising inflation in Spain and Poland weighs on business confidence

Seasonally adjusted S&P Global Spain Manufacturing PMI® From 49.9 in August to 49 in September. The decline was due to lower output and new orders due to high inflation and lower demand. As a result, business confidence in the future slipped into negative territory in an uncertain economic environment characterized by high inflation and low consumption.

S&P Global Polish Manufacturing PMI Confidence in Polish manufacturing remains subdued® September was well below the unchanged mark of 50. The reason for the slowdown is that output and new orders have fallen at historically significant rates. Business confidence was subdued as input cost inflation accelerated this month for the first time since March as energy prices rose. Companies were forced to lay off staff to cut costs, leading to a fourth straight decline in employment levels.

Optimism declines in key sectors in Italy, Latvia and Germany

Italy’s business optimism index fell to 105.2 in September from 109.2 in August, according to Istat’s Istat economic sentiment index. Confidence in services fell to 95.9 from 103.0, while confidence in manufacturing fell to 101.3 from 104, as expectations for future orders deteriorated. The retail trade confidence index also fell to 110.6 from 113.4. Respondents are more pessimistic about current business trends and future sales than in the previous month.

In September 2022, the business confidence indicator for all business sectors in Latvia remained negative for the fourth consecutive month, according to data from the Business Trends Survey conducted by the Central Statistical Office (CSB). Indicators for construction, services and manufacturing continued to decline in September compared with August, due to a lack of demand, higher energy prices, and a shortage of labor. The construction industry confidence index was -17.2, down 1.6 percentage points from the previous month; the manufacturing confidence index was -8.4, down 2.7 percentage points from the previous month.

Optimism about the German economy fell to 84.3 in September from 88.6 in August, according to the ifo business climate index. The index hit its lowest point since May 2020, affecting all four of the country’s main industries, including manufacturing, services, trade and construction. The company believes that their current situation is significantly worse. Pessimism over the next few months has also increased, with retail expectations at historically low levels.

Business confidence drops sharply in Belgium and Czech Republic

Confidence in Belgium fell sharply to -11.8 in September from -5.8 in August, according to the monthly business survey conducted by the National Bank of Belgium. Business conditions deteriorated in all areas of activity covered by the survey, with the exception of the construction sector, where indicators remained almost stable. Business leaders were less optimistic about the status of their orders and employment prospects.

According to the NR Business Cycle Survey conducted by the Czech Statistics Office, the Czech Republic’s confidence index fell by 3.3 points to 93.6 in September. Industrial entrepreneurs’ confidence in the economy fell for the fourth time in a row. However, the number of entrepreneurs dissatisfied with current aggregate demand remains the same.

UK confidence weighed down by inflation and political instability

The Institute of Directors’ (IoD) economic confidence index, which measures the optimism of UK business leaders, edged up to -43 in September. However, confidence in its own business prospects fell to +20 from +28 in August. Business leaders said Britain’s inflation rate and the political instability of the British government were the main reasons for their pessimism.

Overall business confidence, as measured by the Lloyds Bank Business Barometer, stabilized in September after falling for three straight months from June to August. In the North West and Yorkshire and Humber, however, business confidence fell by 14% and 11% respectively. Confidence remains below the national average in the rest of the UK, including the South West, East Midlands, Northern Ireland, East of England and Wales.

Canadian small business confidence dips slightly

According to the Canadian Confederation of Independent Business (CFIB) Business Barometer, Canada’s short- and long-term small business confidence fell to 49.5 in September, just half a percentage point lower than in August® short-term index. An index above 50 indicates that owners have stronger expectations for operating performance.

The general picture of the business has not changed since August, and full-time hiring plans for the next three to four months remain stagnant. Forecasts for the next three to four months were bleak in most Canadian provinces, with readings below 50. Nova Scotia and PEI are the most optimistic, although their levels are in the mid-50s.